⚖️ Crypto Regulatory Boost: SEC Accelerates Crypto ETFs, Flashing Billions in Crypto Capital

The U.S. securities watchdog has issued a new set of listing standards that will boost ETF approval times and attract billions of new capital to the crypto market.

👋 Welcome to the CoinStats Scoop, your weekly newsletter with the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves, emerging trends, and exciting developments in the crypto space from the past week.

This week in crypto, investors saw a flurry of positive regulatory developments from the United States Securities and Exchange Commission (SEC).

Adding to the bullish sentiment, the week also brought an ‘Avalanche’ of new altcoin exchange-traded fund (ETF) filings, including the world’s first multi-asset cryptocurrency ETP.

The growing crypto-positive regulatory developments and array of new crypto ETF applications are making crypto more accessible than ever before, in a sign of a rising appetite for crypto among traditional investors.

In this week’s CoinStats Scoop, you'll find:

Crypto market analysis and the most important news in Web3 📊

The SEC’s key guidelines to accelerate crypto ETF approvals ⚖️

The AVAX token’s rise on the Bitwise Avalanche ETF filing 🚀

Standard Chartered’s $250M💰 crypto fund 🏦

The launch of the First Dogecoin ETF & XRP ETF 🐶

The BNB token’s meteoric rise to $1,000, creating millions for investors 🔥

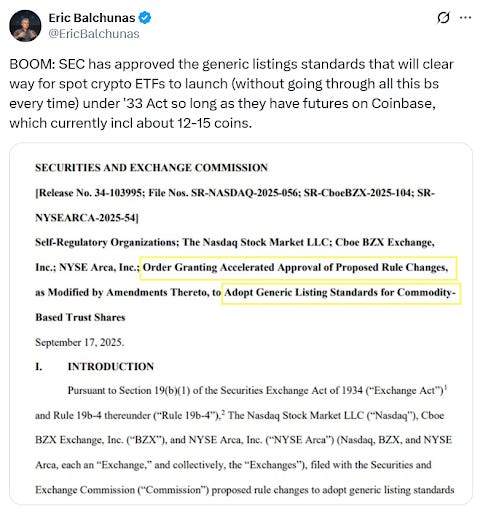

SEC accelerates crypto ETF approvals: a new era for TradFi crypto adoption

🏛️In a landmark decision signaling more investor access to digital assets, the SEC has approved a new set of generic listing standards to accelerate crypto ETF approval.

Crypto ETF approvals took months or even years under the previous administration, partly due to the SEC’s former Chairman, Gary Gensler’s hostile attitude towards crypto.

But the new decision looks to speed up the process of ETF approvals through individual evaluation, in a move that will inspire more crypto ETF applications among asset managers, a net positive for the digital asset market 📈.

“By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets,” wrote the SEC’s new Chairman, Paul Atkins.

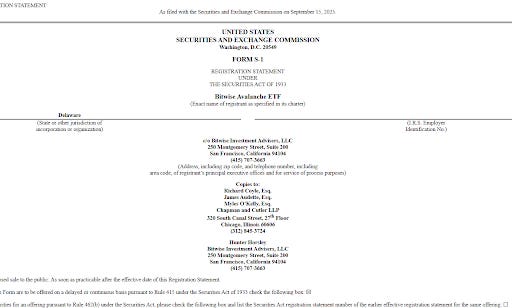

🔥 AVAX token on fire as investors expect ETF ‘Avalanche’ after Bitwise’s filing

Asset manager Bitwise filed for the listing of an Avalanche ETF on the US markets, flashing another bullish signal for the incoming altcoin season.

The crypto asset manager seeks to list the Bitwise Avalanche ETF on US markets, with Coinbase exchange as its custodian, similar to most outstanding Bitcoin and Ether ETFs.

Bitwise’s filing seeks to introduce the third Avalanche ETF to US markets, along with two more Avalanche ETF filings awaiting approval from asset management giants VanEck and Grayscale. The SEC is set to decide on the latter two in October, as one of the most-anticipated events for crypto investors for the next month.

Some of the world’s largest asset managers are looking to offer more regulated investment products, signaling growing mainstream demand for cryptocurrency offerings.

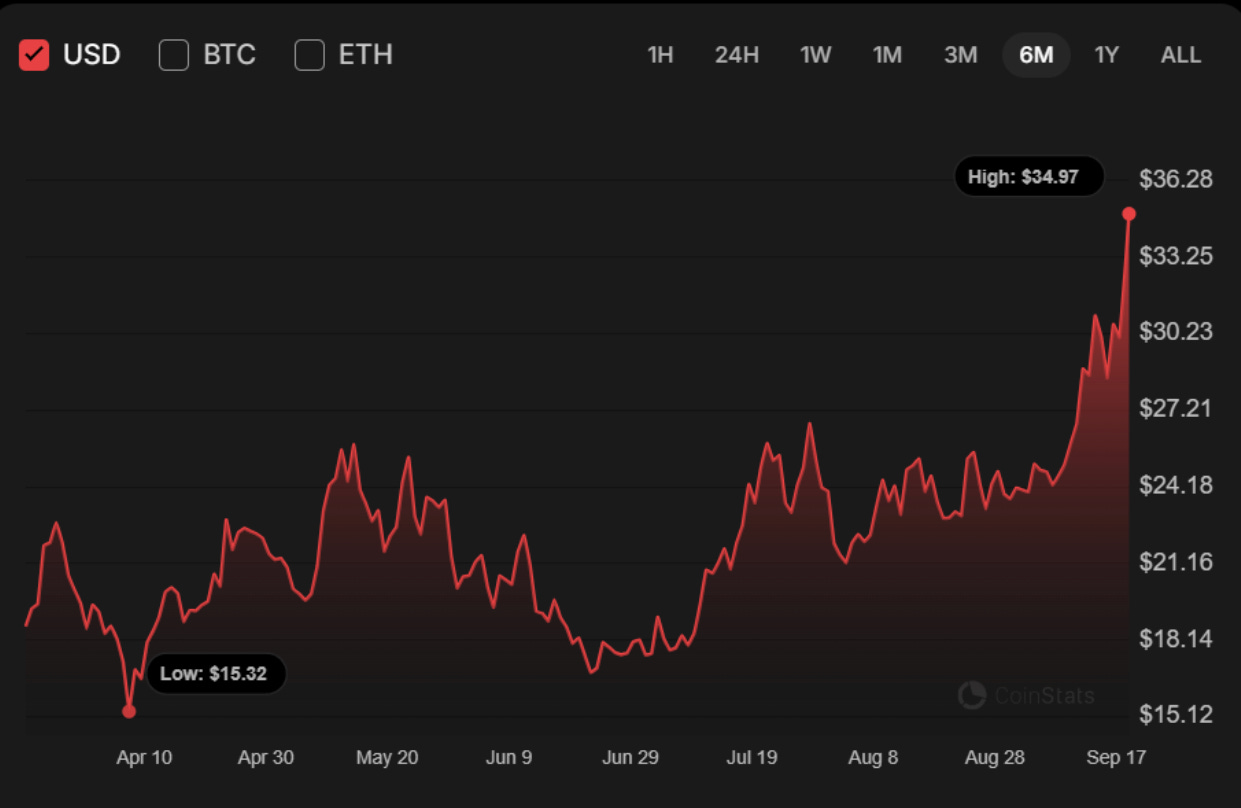

Benefiting from the tailwinds, the AVAX token rallied over 20% during the week🚀, nearly breaching the crucial $35 psychological resistance level.

AVAX is currently the world’s 15th largest cryptocurrency, up 87% over the past 6 months, positioning itself as a leading utility token among smart contract blockchains.

Bringing even more capital to fuel AVAX’s rise, the Avalanche Foundation is raising $1 billion for an Avalanche staking fund in the US, which would acquire and hold AVAX as its main reserve asset.

Standard Chartered is launching a $250 💰 million crypto fund

Global banking and financial services giant Standard Chartered is preparing to launch a large-scale cryptocurrency fund.

Standard Chartered is about to launch a $250 million “digital asset fund” through its investment subsidiary, SC Ventures. The fund will be backed by yet-to-be-announced Middle Eastern investment giants, set to launch in early 2026.

The timing of the fund makes the news particularly bullish 📈, as it signals hundreds of millions in capital for the top cryptocurrencies that will prolong the altcoin season well into 2026.

Many analysts are foreseeing an extended bull cycle 🔄 thanks to the growing institutional capital flowing into crypto, which is typically slower-moving due to business approval processes.

The rapidly piling corporate funds promise extended institutional capital coming into the crypto industry, questioning the relevance of the 4-year bull cycle theory related to the Bitcoin halving.

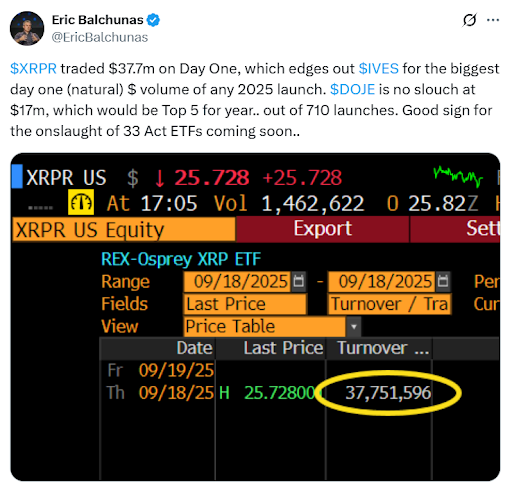

🐶 First Dogecoin ETF & XRP ETF hint at another retail investor frenzy

In another historic milestone for the cryptocurrency space, investors welcomed the debut of the first Dogecoin ETF and XRP ETF on United States exchanges.

These ETFs make the underlying tokens accessible for traditional investors without crypto accounts or firms that are barred from investing in digital assets but can hold ETFs on their balance sheet📊.

Dogecoin has proved its staying power as the crypto market’s leading memecoin, partly thanks to multiple endorsements from billionaire Elon Musk.

The XRP ETF attracted $37.7 million in volume on day one, as the best ETF launch of 2025, while the Dogecoin ETF also saw $17 million, making it a top 5 launch for the year, according to Eric Balchunas, popular ETF analyst at Bloomberg.

“Good sign for the onslaught of 33 Act ETFs coming soon,” said the analyst, referring to the new SEC guidelines ⚖️ to boost crypto ETF approvals, as described above by CoinStats

Market Overview: BNB hits record $1,000 💎 all-time high, Bitcoin sells the news event after FOMC

The Binance platform’s BNB token broke headlines and new all-time highs this week.

BNB breached the $1,000 mark for the first time in history on September 19, as more retail investors are piling into the native utility token of the world’s largest centralized cryptocurrency exchange.

Some traders see this as a catalyst for new all-time highs for BNB, as it crossed an important psychological level that tends to attract significant investor attention, particularly among retail.

Binance's users are incentivized to hold the token, creating permanent demand for BNB.

BNB holders benefit from lower trading fees on the Binance exchange, access to launchpool projects, lower fees on the BNB chain, and the opportunity to gain passive income via staking.

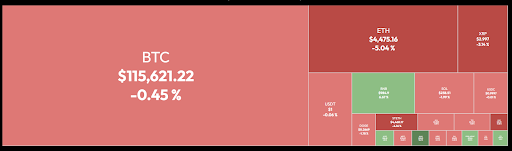

Meanwhile, the leading cryptocurrencies are experiencing a sell-the-news-type correction 📉 after the markets saw a long-awaited interest rate cut in the United States.

Bitcoin was in a consolidation for most of the week, but fell 1.5% on Friday, as the Federal Reserve’s 25 bps interest rate cut was not enough to lift risk appetite for BTC.

Meanwhile, Ethereum price fell 5.2% 📉 during the week, as investor attention continued to move to more speculative altcoins with smaller market capitalization, which can bring more upside potential for the rest of the bull cycle.

Tweets & Memes

💎 Cryptocurrency investor’s $29 million profit on 7-year BNB HODL: patience pays in crypto!

📈 More of the top crypto traders on the Binance exchange are betting on the AVAX token’s price rise.

But is it really Avalanche season for the crypto markets 🤔?

Binance co-founder Changpeng Zhao is celebrating the BNB token’s parabolic 10000x 🚀 rally in 8 years.

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We'll see you next week for another edition of CoinStats Scoop! 😎